“Surround yourself with good people.” That is one of Marcus Lemonis’ fundamental rules for business success. It’s why you need to learn as much as you can about your business partners and investors, as well as the people you hire, so you can build trust in your team. But sometimes things go wrong. Operating funds have disappeared, accounting records could be falsified, or a secret bank account could be discovered. In any case, you learn that a partner is stealing money from the company.

What should you do next? Should you confront your partner and risk sinking your business? Should you hire a private investigator and file a lawsuit to try to recover your money? Or do you just try to pretend like nothing happened in regard to stealing money from the company?

For Marcus, the right solution varies with the circumstances of the business. For instance, he made an investment in an ice cream store that had been part of a regional chain before falling on hard times. After getting to know the people and the market, he entrusted the restaurant to two business partners, only to learn they had mismanaged hundreds of thousands of dollars in company funds.

But one regional manager remained committed to the success of the store. While the original owners parted ways with the company, Marcus asked the regional manager to stay on as a partner and help him get the company on the right track.

5 Types of Business Partner Thefts

Unfortunately, stealing money from the company is all too common in the business world. Even Fortune 500 companies are not exempt. For instance John Rigas, CEO of Adelphia cable company, and several other executives were tried for using corporate funds for personal expenses, and Martin Grass, CEO of Rite-Aid went to prison after being charged with conspiracy to defraud, accounting fraud, and making false statements.

In many cases, the greed of these white-collar criminals is matched by their ingenuity.

If there is money or assets left unguarded, an unscrupulous partner may find a way to take advantage of your trust. Here are several ways a partner can be stealing money from the company.

1. Physical Theft

Do you have a petty cash drawer in the office? If so, do you check the balance every day to be sure nobody has put a hand in the cookie jar? While the loss of a few dollars is unlikely to sink your business, a partner willing to steal from petty cash may graduate to bigger thefts.

Of course, it’s not just cash that you have to worry about. Your partner could also steal supplies from the office, inventory from the warehouse or even take off with a company car or truck. So, any physical assets you have in the business need to be checked on a regular basis to be sure they haven’t evaporated into thin air – or into your partner’s pockets. Several years ago, Marcus considered a potential investment into a New York footwear company, only to find $400,000 was missing from the company’s accounts, causing him to reconsider his offer.

2. Intellectual Property Theft

Many businesses rely on trade secrets for success, such as a special dessert recipe, a proprietary software application or a carefully guarded customer relationship management (CRM) database. But like cash or equipment, these intangible assets can also disappear if a partner is stealing from the company. In fact, these losses can be even more serious than a physical theft because they strike to the very heart of a successful business.

3. Fraud

Just as each criminal is different, fraud comes in many different shapes and sizes. For instance, a partner might engage a close relative or family friend as a “consultant” and pay a large salary or fee from company funds. A partner stealing money from the business could create fake customer accounts and send your products to a post office box or other fraudulent address. Another example would be sending payments to non-existent vendors who are listed in your accounts as having provided goods and services.

Insurance fraud is another way a partner can be stealing money from a business. A partner’s vehicle with “fender-bender” damage might be declared a total loss in order to file a large claim, thereby raising your company’s premium costs. In a few worst-case scenarios, a disgruntled partner might even set fire to the establishment, hoping it burns to the ground so a huge claim could be filed.

4. Embezzlement

If your business partner is keeping the financial accounts, you need to have some sort of monitoring system in place. That can be a challenge if you are constantly out of the office making sales calls or in a manufacturing or service facility handling operational issues.

For an embezzler, stealing money from a company may involve “cooking the books.” That might be failing to account for revenue coming into the business or inflating the expenses going out. Either way, the criminal can pocket those funds. Embezzlers can also manipulate your tax accounts and records.

For instance, your accounts might show that you paid your payroll taxes each month, while in fact your partner took those funds, leaving you with a major liability.

5. Breaching a Fiduciary Duty

Professional firms in financial services, real estate, accounting and law may owe a fiduciary duty to their clients. In other words, you need to safeguard the funds entrusted to your care. But like anything else of significant value, a partner stealing from the company might decide to divert those funds to a personal account or simply withdraw those funds for personal use.

Again, you could wind up facing the consequences of breaching your fiduciary duty, which could involve criminal or civil penalties, as well as having to replace the client’s missing money.

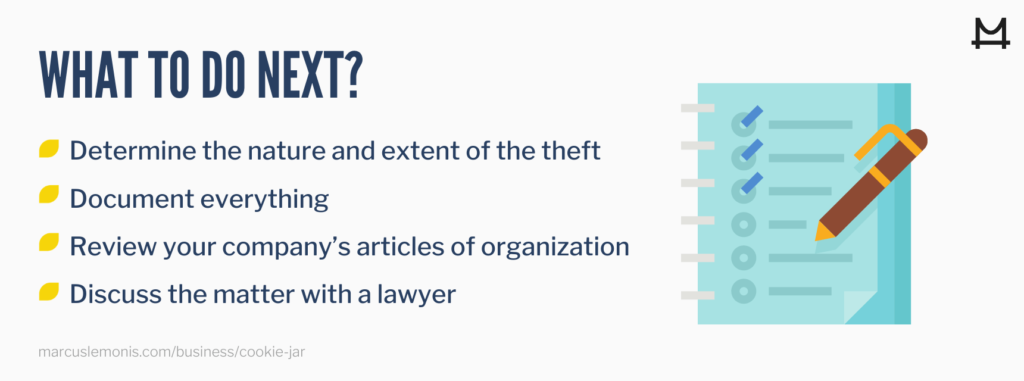

What to do Next?

If you suspect a partner of stealing money from the company, there are several steps you need to take.

- Determine the Nature and Extent of the Theft. Bring in an outside auditor or financial professional to look at your books. Talk with employees who may have witnessed suspicious activities, and try to get a handle on your partner’s actions.

- Document Everything. Determine the value of missing inventory or equipment. Track down phony bills of sale or customer or vendor accounts.

- Review Your Company’s Articles of Organization. You may find a provision in your original business agreement that could provide leverage for getting your money back. If so, be sure to follow those steps carefully to avoid making a mistake.

- Discuss the Matter With a Lawyer. See what legal remedies you can pursue, along with the cost of an attorney’s services. If your loss is substantial, a law firm can engage a forensic accountant or professional investigator to gather evidence for a potential lawsuit to recover the stolen funds.

On the other hand, you want to avoid taking hasty action. Don’t make accusations of stealing unless you have solid evidence of a theft. It’s also a mistake to make threats against your business partner. There is an old saying that “two wrongs don’t make a right,” and you need to be sure you are on the right side of the law in these matters.

There is also a risk that your partner might try to link you to the illegal activity, so you need to be very careful to document your own actions relating to the matter.

What are the Remedies?

When you find a partner stealing money from the company, you need to look for the best way to recover the funds. Perhaps you can appeal to your partner’s better nature or leverage your personal relationship to build a convincing case for returning the funds.

If that doesn’t work you may be able to convince a prosecutor to file criminal charges against your partner, or work with your attorney to file a civil lawsuit aimed at recovering the funds. In any case, you should promptly terminate the partnership in order to prevent further thefts.

You should also do everything possible to keep your business going, including reassuring your employees and customers. You may need to invest in positive marketing and public relations action to regain their trust and avoid a devastating impact on your business. As Marcus says, “If you have trust with somebody, it can survive any downturn, any mistake, any problem. And if you don’t have trust, it won’t matter how good the business is. It will fall apart eventually.”

This article is informational only and subject to errors or omissions. As with any legal or regulatory advice, please consult your legal counsel or tax advisor to make sure you are in compliance with all and any federal, state, city or county rules and regulations. More

- Do you think your business partner might be stealing from the company?

- What precautions will you put in place to prevent your business partner from stealing from the cookie jar?

NBCnews.com. (2012, May 21). 10 CEOs who went from the boardroom to the cell block.

Retrieved from https://www.nbcnews.com/business/markets/10-ceos-who-went-boardroom-cell-block-flna783944