Every entrepreneur wants to create a successful and profitable business; this is a basic and obvious statement. But what does not seem too obvious to most small business owners is how to turn their idea into a small business success. The Bureau of Labor Statistics states that 65% of new businesses in the United States fail within the first five years, while only 25% make it to 15 years or further (U.S. Bureau of Labor Statistics, 2019.) So, how does an entrepreneur manage to become part of the small business success rate? Let’s go over how you can get your company in the small business success stories’ hall of fame. Here are 10 keys to small business success:

1. Provide a Great Product or Service

While marketing is essential for creating buzz and driving traffic to your business, it will only get your business so far. The products or services provided need to be good enough to meet or surpass the clients’ expectations once the customers are there. This is how you create a life-long repeat customer who will, in return, help the business by generating word of mouth.

Turning customers into brand ambassadors is one of the best and most cost-effective ways to get a small business on the map. However, this can only happen if the offering is up to par, and above all else, it provides an outstanding solution to a real problem, which fulfills a need in the market. Many entrepreneurs have developed mind-blowing and innovative products that go nowhere, while others with a straightforward idea take over the market space – Why? Maybe the first group got so focused on the end product, they simply forgot to fix a problem; while the second group found a solution to a common problem to which many potential customers can relate.

2. Do Your Research

Business is never just business; it also needs to be very personal. But this does not mean that entrepreneurs should throw caution to the wind and start businesses based solely on personal opinion. For example, you might think that walking a cat with a leash is a great idea; but is a cat leash store going to be successful? Gut feelings are good to have, but they are not the same as information. It is derived from data, and data comes from research. How big is the potential consumer base and what are the characteristics of these people? It is critical to understand what drives and motivates the buyer personas to target them efficiently. Research is one of the main keys to small business success.

Case in point: Better Not Younger, by Sonsoles Gonzalez, is a small business success story. A 54-year-old veteran from the beauty industry, with nearly 30 years of combined experience at the conglomerates Procter & Gamble and L’Oréal, noticed that there was a gap in the market for a hair care specialty line designed for older women. She realized that the target consumers for all major hair care brands in the market were women 18 to 44. So, in its communication efforts, Better Not Younger chose to focus on fashionable and sophisticated women. “Women over 50 control $20 trillion of net worth. They spend two and a half times more than the average consumer. They’re on social media. They have many of the habits of millennials, yet nobody is talking to them,” says Gonzalez (Brown, 2019.)

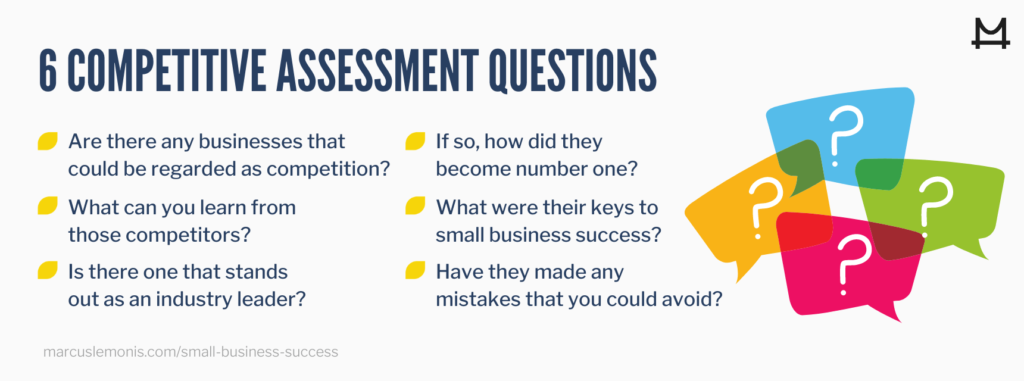

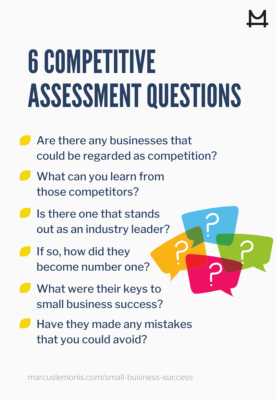

Another critical aspect of research is the competitive assessment. You need to understand the playing field to build a brand that addresses the market’s needs. Here are some questions you should consider asking: Are there any businesses that could be regarded as competition? What can you learn from those competitors? Is there one that stands out as an industry leader? If so, how did they become number one? What were their keys to small business success? Have they made any mistakes that you could avoid?

Finding that there are no potential competitors for your small business can be both a blessing and a red flag at the same time. Is there a reason why they don’t exist? If they did exist, what can you learn from what put them out of business? Research will keep a small business’s focus honest. It is critical that you don’t manipulate the information to fit your gut’s impulses if you want to be part of the small business success stories.

3. Keep Things Organized

This point cannot be stressed enough. From a physical filing cabinet to an organized digital folder structure in your computer, access to information quickly and effectively will make a massive difference in the daily operations of a small business. It is highly recommended to keep specific folders for each aspect of the business appropriately labeled and organized in a manner that makes sense to you and is intuitive enough for anyone in the company to access as needed. Also, backups of digital information are essential, especially when it comes to financial data. It is crucial to store them in a safe place to avert potential chaotic situations down the road.

4. Detailed Record Keeping

Proper bookkeeping helps you know the business’s financial status and what could potentially become a problem moving forward. It can make the difference between becoming a small business success story or not. At the same time, it can also paint a picture to visualize future projections and assist in business planning. “Know Your Numbers,” is a phrase you’ll hear Marcus Lemonis say repeatedly. You must be able to understand how much the business makes and how much it sells. And while many entrepreneurs may only think about hiring an accountant to do their taxes as needed, knowing your numbers refers to much more than that.

For example, you should be able to know off the top of your head—at all times—what your company’s bank balances are, how much your company is invoicing versus how much you are spending, what your final production numbers were for last year, the gross and net profits of your previous quarter, and many more. It is imperative that you look at your profit & loss statements (P&L) every month, that you study your general ledger and understand all the numbers that you’re seeing. Knowing how the cash flow is affected by your company’s accounts receivables and accounts payables will help you make better decisions as soon as they are needed, and not when it’s too late.

You need to be able to make adjustments to your business every quarter to make sure you stay on track towards reaching your annual goals. When it comes to good record keeping in regards to taxes, it pays to tidy up your books. According to the Internal Revenue Service, good records can do much more than that. Here are three additional ways in which detailed records can help a small business owner (Internal Revenue Service, 2020):

- Identify sources of income: with the books, you should be able to separate business from non-business receipts and determine taxable from nontaxable income.

- Keep track of deductible expenses: everything should be recorded as it occurs to avoid leaving anything out when preparing tax returns.

- Support items reported on tax returns: if upon examination of the tax returns, the IRS requires additional explanation on the items reported, a complete set of accurate and detailed records will be critical to expediting the examination.

5. Keep Focus & Have Patience

When starting a new business venture, maintaining sights on a set goal is imperative to measure success. You must determine the overall goal and set smaller milestones that will ladder up along the way. A highly recommended practice is to draft a “to-do list” every night before going to bed and tackle it starting first thing in the morning to help you stick to a plan and avoid distractions. But it is vital to make a realistic to-do list—so as not to set yourself up for failure.

With that being said, it is also important to have resilience, not only to face daily challenges but also to be patient when it comes to overall business results expectations. Most successful businesses are not built overnight; note that it can take years to get a company to achieve its full potential and to become a small business success story.

6. Be Prepared to Make Tough Decisions

Every business owner must make sacrifices for the sake of the organization. But there may come a time when the toughest decision you must make is putting your ego aside. Pride can kill a business and not all decisions will always align with your opinions and beliefs. And although a small business owner should have deep personal and emotional stakes in the business, these cannot be the guiding force behind every daily choice made. You should recognize when you need help and accept that there are people who may know more than you about certain aspects of the business. It is ok to ask for help. You must be prepared to check your ego at the door and listen to what others are saying—especially if it’s coming from your consumer. It is not easy to approach a situation humbly and with an open mind, but it is the best way to make a sound business decision.

7. Keep Your Overhead to a Minimum

“Cash is King” is a phrase often used, and it is not wrong; cash is one of the keys to small business success. Most business owners understand that cash liquidity is imperative as the first line of defense against any unforeseen challenge. But not all small businesses can comply with a large enough reserve to absorb sudden losses in income or increases in expenses. The larger the cash flow, the more stable the company; but still, “50 percent of small businesses are operating with fewer than 15 cash buffer days” (JPMorgan Chase & Co., 2020.) This is one of the most important lessons that small businesses learned from the coronavirus pandemic: if all of a sudden there is no income, how much cash will it take to cover the overhead costs?

“Cash reserves provide small businesses with liquidity, a resource to draw upon when times get tough and an easy way to pay employees, vendors, and suppliers. In other words, cash reserves ensure a small business’s security” (Buchanan, 2018.)

A good rule of thumb is not to grow the business’s overhead past what the cash reserves can support. It is much easier to expand the company as one increases the cash liquidity, rather than being forced to downsize later because, in case of an emergency, the business couldn’t cover its overhead costs.

8. Know the Operational Needs

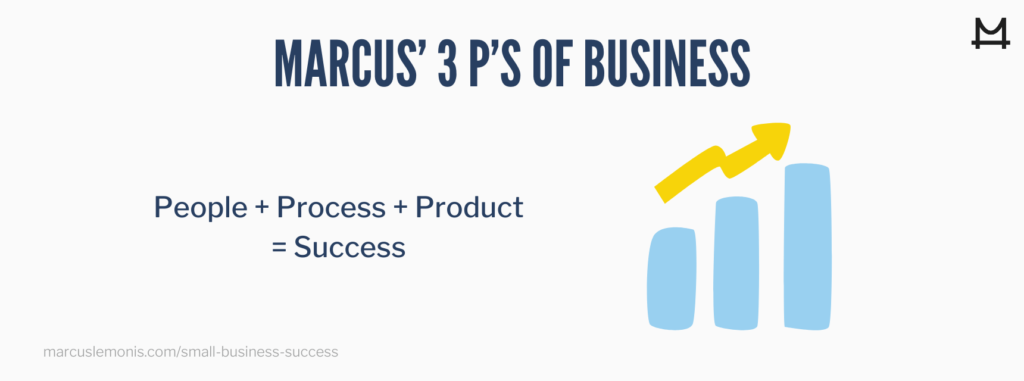

You need to know everything about your business, and this knowledge should not be limited to just the numbers. It is essential to understand what the company needs to operate effectively. This includes employees, equipment, materials, and anything else that is essential. But there’s also the intangible aspect that needs to be considered. Efficient processes and inventory management can seriously affect operational costs. Researching best practices in the specific industry and testing to implement what works best for the business—through trial and error—could be a long and tedious process. However, it will make your business that much more profitable and successful.

9. Hire the Right People and Treat Them Well

This is one of those categories that could fall under making tough decisions; but it is imperative to have A+ team players in the company. All small business success stories have something in common: they know that the people they hire become keys to their small business success. In a small business, more than in large corporations, every employee needs to be trusted to manage his or her daily responsibilities with as little oversight as possible. The structure needs to be as lean as possible to keep the overhead costs at a minimum. So, no small business can afford to waste a position by hiring someone who is not a fit for the role. But the same is true about the opposite scenario. No small business can afford to lose a star employee. Build your team and treat them well. Listen to them and help them grow.

The best business leaders grow their team because they know that their team will grow the business in return. When it comes to hiring, it goes beyond knowledge and talent; it is crucial to consider the type of company culture you aim to achieve. Candidates should be resourceful and capable of wearing multiple hats, especially at the beginning, when the business is taking form. When in doubt, the recommendation is to lean towards a person with all the soft skills that fit the position and company culture, who is trustworthy and seems capable of learning the technical skills, instead of choosing the one who simply excels at the technical skills and may cause problems with the team dynamic later. Your team is the business’s driving force. When you choose a new team member, attitude, personality, and compatibility are key. “People who are more psychologically well and happier tend to be better producers,” says Tom Wright, Ph.D., an industrial-organizational psychologist and management professor at Kansas State University, who studies the role of psychological well-being in job performance and employee retention. The happiness and well-being of your employees can benefit the company immensely; the fact is that when morale is high, the team usually performs more efficiently. According to Wright, “psychologically well employees tend to be more focused on work activities and not waste as much time on daydreaming and other non-productive activities” (Novotney, 2010.)

10. Always Look to Improve

Avoid complacency and being blind to innovation. Once things start going well and the business finds its groove, it is time to start looking for ways to improve. Maybe it is automating a manual part of the process, adding a new offering, creating a unique flavor, or opening extended hours. Whatever it may be, just note that every business always has room for improvement. You need to keep moving to avoid becoming stagnant; innovation is imperative to make you a small business success story. Even giants like Blockbuster Video, Kodak, and Borders Bookstore—having enormous cash liquidity—suffered severely from being resistant to change. As soon as it gets too comfortable, the competition will take advantage and find a way to take the lead. Through consumer research, you can find pain points that you may not have been aware of; maybe a client’s suggestion could become the company’s next success story. New ways to improve your business will happen naturally by just being observant, open, and by listening to your team and the clients.

As a bonus, here is key #11: In the words of Marcus himself, “this idea that business isn’t personal is total B.S. Business is personal” (Huddleston, 2019.) So, above all else, you must be able to make your stakes in the company personal to celebrate the successes and, most importantly, to feel the pain of the mistakes and learn from them. These are fundamental keys to small business success. Take well-informed risks to expand and grow, but note that you can only make these decisions once a solid foundation has been built. If something goes wrong, at least the business will have a big enough cash safety net to break its fall. Lastly, to achieve success, you must see the venture as a competition, a long and steady marathon, not a sprint. So remember to stay focused, hydrated, and well-rested with the goal line always in mind.

- Which tip above is your favorite?

- How are you applying these 10 tips to your business?

Brown, R. (2019, March 25). Veteran beauty executive Sonsoles Gonzalez’s new haircare brand celebrates women in their late 40s and beyond. Retrieved from https://www.beautyindependent.com/sonsoles-gonzalez-new-haircare-better-not-younger/

Buchanan, E. (2018, May 10). Cash is king: why small businesses should care about cash-flow management. Retrieved from https://www.forbes.com/sites/forbesfinancecouncil/2018/05/10/cash-is-king-why-small-businesses-should-care-about-cash-flow-management/

Huddleston, T., Jr. (2019, November 05). Marcus Lemonis: The idea that business isn’t personal is ‘total BS.’ Retrieved from https://www.cnbc.com/2019/11/05/marcus-lemonis-business-is-personal.html

Internal Revenue Service. (2020, April 28). Why should I keep records? Retrieved from https://www.irs.gov/businesses/small-businesses-self-employed/why-should-i-keep-records

JPMorgan Chase & Co. (2020, April). Small business cash liquidity in 25 metro areas. Retrieved from https://institute.jpmorganchase.com/institute/research/small-business/small-business-cash-liquidity-in-25-metro-areas

Novotney, A. (2010, December). Boosting morale. Monitor on psychology, 41(11). Retrieved from http://www.apa.org/monitor/2010/12/morale

U.S. Bureau of Labor Statistics. (2019, October 30). Business employment dynamics – table 7. Survival of private sector establishments by opening year. Retrieved from https://www.bls.gov/bdm/us_age_naics_00_table7.txt