The Importance of Waiting for “The One”

Have you ever been in love? You just feel different. That’s because your brain starts activating the pleasure center of your brain. The reason that’s so significant is explained by Dr. Pat Mumby, a professor of neurosciences at Loyola Chicago. She says that chemically speaking, falling in love leads to a one-track mind, hyper focused on whoever you’re in love with.

In her words, we “lose our rational perspective.” That’s really important to be aware of because this same concept can be applied to falling in love with a business opportunity. If you understand the pitfalls, you can always make sure to come in with clear eyes. You just have to create a process that ensures that critical approach, and then as Marcus Lemonis would put it, “Trust the process.”

This article lays out such an approach, so you can make sure you’re vetting business opportunities, rather than falling under the spell of a whirlwind romance with a company or a new business idea.

The Benefits of Keeping Options Open

You Can Get a Better Deal by Understanding Your Next Best Option

- The Federal Trade Commission has a great write-up explaining why competition is good for the marketplace. They use the example of a grocery store, explaining that if there was only a single one they wouldn’t have any reason to lower prices or improve quality. You can certainly ask them to, but they know you’ll keep coming back regardless because there’s no alternative. So, by dealing with a single person, you give them an unfair amount of power. That’s an important economic principle and a great mentality to bring into negotiations. More options can lead to more value, so make sure you’re keeping options open. Now let’s apply that concept to a small-business scenario.

- Let’s say you run a business that sells shopping carts. CVS might buy a huge batch, offering you $100 per cart. You were really hoping to get more like $125 per cart, but are nervous about saying anything because that’s a huge gap and you don’t want to blow the deal. Well, great news. You don’t have to be nervous. You just need to reach out to Walgreens, Rite-Aid, and Whole Foods. You make your pitch, they love it, and offer $90, $110, and $130 per cart, respectively. So, when you sit back down with CVS, this time you’re informed and fearless. You understand your next best option and advocate for yourself knowing that’s in your back pocket.

Keeping options open allows you to rebalance the power during business conversations and unlock value. That’s the power of knowing your “B.A.T.N.A.,” the best alternative to a negotiated agreement.

It Allows You to Compare Offers

Keeping options open allows you to compare all aspects of a deal until you find the right fit. That’s something DaimlerChrysler found out the hard way after their failed merger in 1998. The companies had high hopes, with Daimler competing in the luxury market, Chrysler in the value market, and both hoping to strengthen their foothold on the other’s continent. There was a natural synergy at first glance, but they didn’t take a close enough look at other factors. Chrysler typically paid their executives higher salaries. Daimler maintained higher quality standards.

They even had different philosophies on how to run a company, with Chrysler preferring agility, and Daimler, structure. The deal went through, but the marriage never really took hold and ultimately dissolved. So, in your negotiations, keeping options open allows you to take a look at the complete picture. Sure, the money works out with that new supplier, but what about their quality? Are they flexible if you need more output? Do you believe in their leader? Do you have faith that their company will exist in five years? Are they up against external forces you need to be aware of? Keeping options open allows you to compare offers on multiple levels. It opens your eyes to the fact that the best deal financially isn’t always the best deal overall.

Multiple Offers Creates Leverage

Exploring a few different options gives you such an advantage that sometimes people actively try to prevent it. They do this by requesting exclusive negotiating rights.

They want to know that you’re actually invested and not just using their offer to create a better one elsewhere. But keep in mind, negotiating with just one option violates that economic principle we’ve already explored: creating value through competition. Max Bazerman, a professor at Harvard Business School, had a great way of putting it when he said, “Fall in love with three, not just one.” Also keep in mind that multiple offers are great when you’re making them. Laying out a few different options simultaneously introduces more variables, and therefore, more solutions. You’re giving yourself more opportunities to help it all click into place.

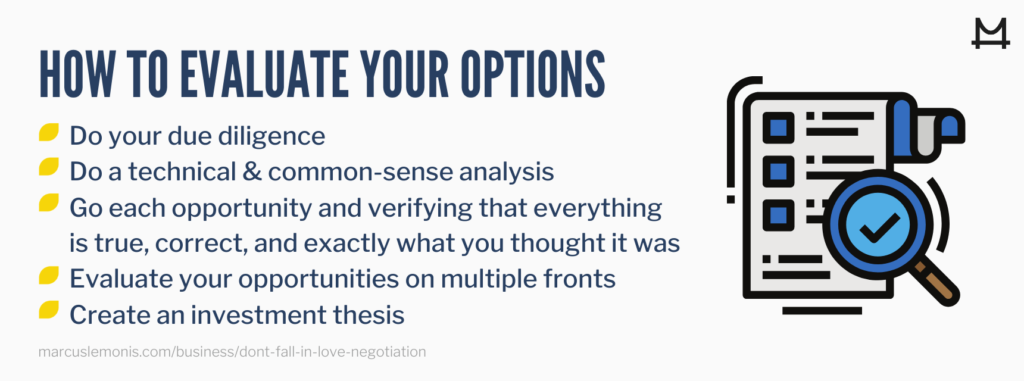

How to Evaluate Your Options

Before you fall in love with an opportunity, do your due diligence. That’s just a fancy way of saying that you need to check into everything while you’re keeping options open. The specifics will flow from the opportunity, but you’re pretty much just doing both a technical and a common-sense analysis. Let’s say you make laundry detergent and are looking to buy 20,000 eco-friendly containers every single month. That’s a huge transaction. Have you visited their factory and does it look like it can handle the volume? Have they ever filled an order this large before? Have you talked to some of the other people they’ve done business with? Have you met the people running the project? Are they easy to deal with? Have you looked at a sample and is it high-quality? Is this a cultural fit, or a fail, like we explored in the DaimlerChrysler example?

You’re also going through each opportunity and verifying that everything is true, correct, and exactly what you thought it was. People make mistakes. Were they doing a little math and you noticed they forgot to “carry the one?” That’s the sort of assessment that Marcus says he could’ve done a better job with when he invested in a blue jean company in California. After they closed the deal, Marcus discovered that their inventory wasn’t quite what he was picturing. He also discovered they’d burned bridges with vendors. There was even a bunch of debt that took Marcus by surprise. He offers this up as a lesson for small business owners.

Don’t fall in love with the brand before doing your research. Evaluate your opportunities on multiple fronts, so you can always pivot if it looks like it’s time. Let’s take a look at one especially helpful tool that makes sure you’re evaluating every opportunity in an unemotional way: an investment thesis.

The Importance of an Investment Thesis

Bain, a global consulting firm, says you should carefully outline exactly what you want out of a transaction before you start negotiating. Newell, a consumer products company, could’ve done a better job of that before acquiring Rubbermaid. Newell loved Rubbermaid because they fit their general strategy of acquiring consumer goods companies with high margins. But Newell rushed the process, and quite frankly, failed to see what Bain called “A raft of problems, from extensive price discounting for wholesalers, to poor customer service, to weak management.” Simply put, Newell fell in love, rushed their evaluation, and overpaid. But that won’t happen to you. Because once you make an investment thesis, you’ll be able to anchor your evaluation in logic. You won’t get swept up in the moment. Instead, you’ll make sure each opportunity checks the boxes you’ve created with a level head.

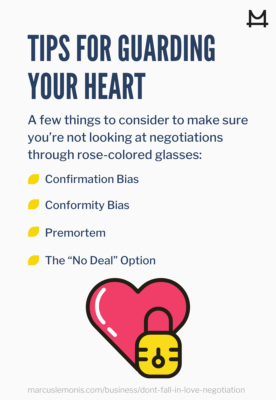

Tips for Guarding Your Heart

You might’ve heard Marcus say, “If you don’t have emotion and you don’t have passion, then you shouldn’t be in business.” He’s basically saying that your emotion can be a great thing. And it is. It’s exactly what makes you a go-getter. But it can also play tricks on you. So, you just want to make sure it’s not contaminating your decision-making process. Below are a few things to consider to make sure you’re not looking at negotiations through rose-colored glasses.

Confirmation Bias

There’s a great article in The New Yorker explaining that new information doesn’t always change your mind. Your brain has a tendency to weigh new information more heavily if it confirms what you already think. So, be aware of this psychological factor that might be drawing a disproportionate amount of attention to a variable that doesn’t deserve it.

Conformity Bias

Another bias to be aware of is the tendency to go along with the group. You’re probably already aware of this on some level, but a psychologist named Solomon Asch conducted a famous experiment at Swarthmore College that proved it. He hired actors to give an obviously wrong answer during a study to see if the subject would go along with it. In short, a surprising amount did.

So, just know that everyone else falling in love with a deal doesn’t mean that you should, too.

Premortem

Gary Klein, a Ph.D. in experimental psychology, pioneered an exercise called a “premortem.” He was concerned that when teams fall in love with an idea, no one speaks up about the negatives. So, in his premortem exercise, you project yourself to an imaginary point in the future and take your best guess at why the project failed. It’s just a helpful risk-assessment technique that forces you to look at every angle.

The “No Deal” Option

You obviously want to make a deal, but if it’s not there, it’s not there. The last thing you want is to make a deal just so you can feel like you’ve succeeded. Because if you succeeded in making the wrong deal, did you really succeed overall? Never forget that you always have the freedom to walk away, and you fortify this freedom by keeping options open.

Never Fall in Love with an Investor

For a lot of small business owners, closing a deal with an investor is a dream come true. But before you get hearts in your eyes, apply what you’ve just learned about negotiating. Way back in 1998, two Stanford students had developed a PageRank system for the internet. They tried to sell it to AltaVista for $1 million, cash the check, and focus on school. But Altavista declined. As did Yahoo. At the time, that was probably a crushing disappointment for the young founders. But don’t shed too many tears for those guys. Because those kids were Larry Page and Sergei Brin. Their system evolved into what we now know as Google, and as of January 2020, was valued at over $1 trillion. So, rewind back to the conversations they originally had with AltaVista. Were those young college kids falling in love with the prospect of $1 million? Did they think AltaVista saw the full potential in their product? Were they ready to walk away if AltaVista came back with an unfair offer? We’ll never know what they were thinking, but it’s a good reminder to do your research and weigh all of the options before “falling in love” with an offer.

You’ve probably heard the famous Elvis song, “Fools Rush In.” You might’ve even rushed into love yourself. Maybe you really wanted a relationship, so you ignored a bunch of red flags. Maybe you dated the first person who liked you back and missed out on a better fit. Or maybe you never bothered with dating, so you really had no idea who was out there. In that sense, falling in love with a person is a lot like falling in love during a negotiation. Fools rush in.

So, the next time you’re exploring an opportunity, make sure you have a process, let your brain take the wheel, and tell your heart to take a back seat until you’ve done your due diligence and made sure it’s the right partnership for you and your business.

- How will you guard your heart during your next negotiation?

- Which tips from the above can you use in your next negotiation?

Derrick, J. (2016, July 25). Remember when Yahoo turned down $1 million to buy Google?

Retrieved from https://finance.yahoo.com/news/remember-yahoo-turned-down-1-132805083.html#:~:text=Back%20in%201998%2C%20two%20individuals,resume%20their%20studies%20at%20Stanford.&text=AltaVista%20turned%20down%20the%20offer%20to%20acquire%20the%20companyFTC.gov. (n.d.) Competition counts. How consumers win when businesses compete [PDF file].

Retrieved from https://www.ftc.gov/sites/default/files/attachments/competition-counts/zgen01.pdfHarding.D., Rovit, S., & Lemire, C. (2004, December 1). Staying cool when deal pressures mount.

Retrieved from https://www.bain.com/insights/staying-cool-when-deal-pressures-mount/Klein, G. (2007, September). Performing a project premortem.

Retrieved from https://hbr.org/2007/09/performing-a-project-premortemKolbert, E. (2017, February 20). Why facts don’t change our minds.

Retrieved from https://www.newyorker.com/magazine/2017/02/27/why-facts-dont-change-our-mindsLoyola University Health System. (2014, February 6). What falling in love does to your heart and brain.

Retrieved from https://www.sciencedaily.com/releases/2014/02/140206155244.htmMcLeod, S. (2018, December 28). Solomon Asch – conformity experiment.

Retrieved from https://www.simplypsychology.org/asch-conformity.htmlOstle, D. (1999, November 22). The culture clash at DaimlerChrysler was worse than expected.

Retrieved from https://europe.autonews.com/article/19991122/ANE/911220842/the-culture-clash-at-daimlerchrysler-was-worse-than-expectedPon Staff. (2020, July 6). Understanding exclusive negotiation periods in business negotiations.

Retrieved from https://www.pon.harvard.edu/daily/dealmaking-daily/understanding-exclusive-negotiation-periods/Swartz, J. (2020, January 16). Google becomes third U.S. tech company worth $1 trillion.

Retrieved from https://www.marketwatch.com/story/google-parent-alphabet-joins-1-trillion-in-market-value-for-first-time-2020-01-16