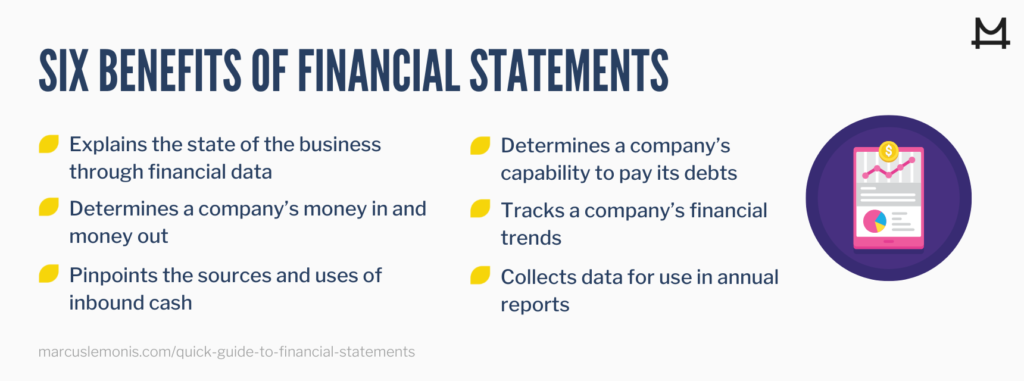

Financial statements tell the story of how a business is performing. Marcus often says, “Know your numbers,” and the numbers in financial statements help to gain insight into gross profit, net profitability, cash flow, and liquidity. Taken together, these summary reports give a complete picture of the financial health of a business.

The Main Types of Financial Statements

1. Income Statement

An income or profit and loss statement is the all-important tracking mechanism for money in and money out. This typically includes revenue, losses, and expenses during a set period.

2. Balance sheet

A balance sheet includes the positive and negative financial data from a business. Assets are on the plus side, while liabilities—debts, taxes, and payables, for example—are on the minus side. The balance sheet also includes equity, or the money that would remain if the business sold its assets and paid off its liabilities.

3. Statement of Cash Flows

The statement of cash flows tracks a business’s working capital, while summarizing the amount of cash and cash equivalents that enter and leave the company. These statements measure how well a business can pay off its debts while funding operations such as payroll, inventory, and other expenses.

4. Other Types of Financial Statements

Another common financial document is the statement of owner’s equity, also called a statement of changes in equity.

This highlights a company’s retained earnings, such as profits reinvested in a business as opposed to paying shareholders or owners, over a set accounting period like a quarter or month.

Nonprofits have another common financial document called a statement of functional expenses, which is self-explanatory: it tracks expenses used for the organization’s fundraising, programs, and management.

When Financial Statements are Needed

Financial statements are used to internally track the metrics described above, but they are also valuable for presenting information to potential investors, lenders, or buyers.

Publicly traded companies in the United States are required to file an income statement, balance sheet, and statement of cash flows to give a snapshot of their finances to help stock market investors make informed decisions. This standard is known as the GAAP, for Generally Accepted Accounting Principles, and its main goal is to ensure transparency in a company’s finances.

How to Read Financial Statements

Each type of financial statement listed above focuses on a different set of data. More than just spreadsheets, these data sets tell the story of how a company manages, spends, and, if it’s being run efficiently, makes its money.

Income statements feature revenue, or the amount of money coming into the company, and expenses and cost of goods sold, which assess the amount of money being spent.

Also featured in income statements are gross profit and both operating and net income.

A balance sheet includes assets and liabilities, as well as shareholder equity. The statement of cash flows looks at money in and money out as it relates to operating, financing, and investment.

Reading each type of financial statement will offer insights into the different elements of the business, adding up to a complete picture.

- What kind of story does your company’s financial statements tell?

- How is your company using financial statements internally?