Ready to turn your passion into a successful business? Great! The first thing Marcus would say to you is, “if you don’t have emotion and you don’t have passion, then you shouldn’t be in business, because money is a byproduct, not the purpose.” And then he would probably follow that with, “have no fear and be willing to fail.” When starting a business, you must take many crucial steps to make sure your venture is built on a solid foundation – Because being willing to fail is not the same as setting yourself up for failure. After all, we know what happened to the first two little pigs that did not take the time to build their houses properly. When the big bad wolf came, they lost it all. If your business ends up taking a financial downturn for any reason, and you don’t want to lose it all—including personal assets like your family’s home, vehicles, and retirement savings, then you should most definitely keep reading.

When starting a new venture, it is vital to keep your business separate from your personal life and from the lives of any other partners or owners, if there are any. That way, personal assets don’t come into play if your business needs to settle a debt. The best way to do this is by establishing a limited liability company or LLC. Being part of an LLC means that banks and legal entities cannot put your personal assets at risk. Therefore, as a member of an LLC, you are only responsible for the extent of your investment in the business. But LLCs are not only useful from the liability perspective, they also reap certain tax advantages and tend to receive boosted credibility and management benefits (Factor Finders, 2018.)

Also, LLCs are generally easier to set up and much more flexible than the larger and more structured corporations; and they tend to have fewer reporting requirements. If you’re wondering how to start an LLC, we have narrowed it down to five easy steps:

1. Select a Name for Your LLC

Your business’s name plays a crucial part in your future success. You must give this part of the process a lot of thought. “The wrong name can do worse than fail to connect with customers; it can also result in insurmountable business and legal hurdles. In contrast, a clear, powerful name can be extremely helpful in your marketing and branding efforts” (Harroch, 2016.) You can try a quick online search of already existing businesses to determine the availability of your proposed LLC’s name. This is something you should always do in your state and at a national level if you plan on expanding your business in the future. You could also search www.uspto.gov to get an idea of whether you can get a trademark or service mark for the name of your company or product.

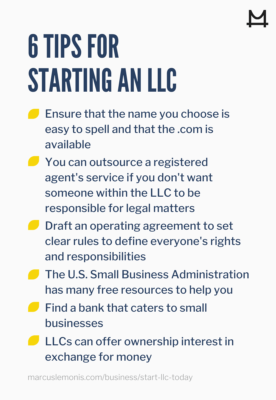

Tip: Ensure that the name you choose is easy to spell, sounds good when said out loud, and that the .com is available before you even start the process to register it.

You might encounter certain state laws and restrictions that won’t allow two different business entities to share a name. So, for example, if you are trying to register “Marcus Shop, LLC,” and there already happens to be a “Marcus Shop, Inc.,” you might not be able to register it. But then again, you shouldn’t want to either. You must check for similar-sounding names or competitors’ names that may confuse your clientele. You could lose potential business if people go to your competition, thinking it is your same company. Now that you have your name—if you are not planning on submitting your paperwork right away and the LLC name you’ve chosen is available—you should reserve it to avoid losing it.

“Nearly every state allows you to reserve a name by filing a form and paying a name reservation fee. The length of the reservation period, filing fees, and renewal policies vary from state to state” (Haskins, 2020.)

2. Appoint a Registered Agent

As a business owner, you will be getting important legal documents. Some will come by mail, while others, such as court notices, might arrive in person. A registered agent is an individual you assign as the person who will be receiving lawsuits, subpoenas, and other official documents on behalf of your LLC. Ideally, you would delegate this position to someone else so you may focus on more important things in your operation without running the risk of missing out on critical legal deadlines or having to be available in-person to sign a document.

Tip: You can outsource a registered agent’s service if you don’t want someone within the LLC to be responsible for legal matters. Entrepreneur services such as incfile.com or LegalZoom can help your business manage important legal documents for a fee while providing an added layer of privacy for your operation.

3. Prepare an Operating Agreement

LLCs’ operating agreements are like the rules of the game that you must establish before you start playing. It is a document that stipulates how your LLC will be managed, and it should include things such as:

- Percentage of members’ ownership interests

- Powers and duties of members and managers

- Allocation of profits and losses (Nwatu, 2016)

Also, if there’s a board of directors, this document should list who the members will be, their voting rights, the members’ succession rights and procedures for transferring interest in the event of a buyout, death or other circumstance, as well as details on when board meetings will be held.

Tip: Although most states might not require you to file the operating agreement as part of your paperwork, it is vital for your business to draft an operating agreement to set clear rules to define everyone’s rights and responsibilities from the start and to avoid future disputes.

One more thing which is essential to include in the document is a delineation of how to dissolve the company. If you voluntarily decide to terminate your business venture or involuntarily go out of business, the operating agreement also dictates how to proceed and what will become of the assets—much like a last will & testament for your LLC.

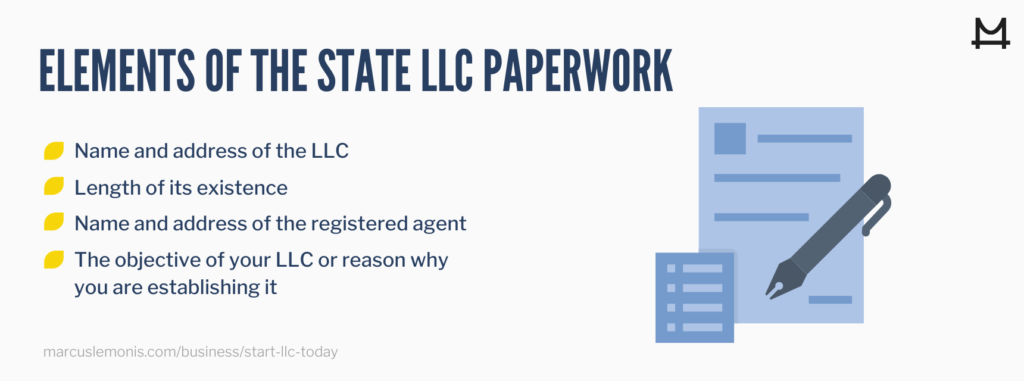

4. File State Paperwork

Depending on your state’s rules and procedures for establishing an LLC, you must file a document titled “Articles of Organization” which lists basic information about your organization, such as:

- Name and address of the LLC—most states will not accept PO Box addresses.

- Length of its existence—some entrepreneurs will register temporary LLCs for particular projects. If you plan to be in business for the long haul, you do not need to determine your venture's longevity.

- Name and address of the registered agent (see step #2)

- The objective of your LLC or reason why you are establishing it

How to start an LLC will vary from state to state, but most will have you submit the paperwork to the office of the secretary of state. Note that there’s a charge for filing your company’s paperwork with the state. Because each state has its own procedure for how to start an LLC, the filing fee and costs will vary. The forms must usually be signed by the business owner or person forming the LLC, and in some states, the registered agent.

Tip: The U.S. Small Business Administration has many free resources to help you figure out how to start an LLC. Visit this link to see the information specific to your state.

5. Get Certified in Your State

Congratulations! If you got to step five, your LLC’s formation documents are already filed and approved by your state. The state should have issued you a certificate or some other document confirming that your LLC formally exists. With this certificate, you can proceed to request a tax ID number from the IRS, register your business to get specific licenses for your line of work, and set up a corporate bank account. Please note that if your LLC’s business expands to more than one state, you may need to register in those other states as well. And although it will cost you to file with each state, the documentation won’t be too different from what you already filed in your state. The one thing that could prove to be a bit tricky is designating a registered agent who is a resident of the state where you are filing the paperwork to request an authorization to do business.

Tip: Make your due diligence on business checking accounts, and don’t just assume that your personal bank, which you know and love, will be the best option for your business. Find a bank that caters to small businesses and establish a relationship with the key players managing your account to create a successful partnership.

The choice to turn your passion into a business is all yours. When you decide to move forward as an entrepreneur, it just makes sense to be 100% in charge of your business. Through an LLC, you will have the freedom to make your own business decisions without necessarily affecting your personal assets. A limited liability company will allow you to own and operate your business on your own terms, as established in your operating agreement.

Similarly, because LLCs allow you the opportunity to manage your business, minus most of the liabilities of a sole proprietor, you’re able to mitigate fear when you take risks with your business. Also, by making a move from a sole proprietorship to an LLC, you demonstrate to your clients, employees, and business partners that you have taken the initiative to officially commit to your business by investing the time and money to take this step. This also validates your dedication and commitment to the banks; consequently, operating as an LLC will also increase your chances of obtaining a business loan. So, are you ready to start an LLC?

Bonus Tip: Because LLCs are treated similarly to corporations, they also provide you the opportunity to offer ownership interest in the business in exchange for money—such as securing capital from angel investors. This is leverage you wouldn’t have as a sole proprietor of your business.

This article is informational only and subject to errors or omissions. As with any legal or regulatory advice, please consult your legal counsel or tax advisor to make sure you are in compliance with all and any federal, state, city or county rules and regulations. More

- What step are you on in your LLC process?

- If you have started an LLC, what other tips can you give your fellow business owners?

Factor Finders (Ed.). (2018, August 7). Why starting an LLC should be your next business venture. Retrieved from https://www.factorfinders.com/top-advantages-starting-llc

Harroch, R. (2016, October 24). 12 tips for naming your startup business. Retrieved from https://www.forbes.com/sites/allbusiness/2016/10/23/12-tips-for-naming-your-startup-business/

Haskins, J. (2020, May 8). How to start an LLC in 7 Steps. Retrieved from https://www.legalzoom.com/articles/how-to-start-an-llc-in-7-steps

Nwatu, I. S. (2016, May 18). Basic information about operating agreements. Retrieved from https://www.sba.gov/blog/basic-information-about-operating-agreements