Are you wondering how to donate to charities? As a business owner, if you find yourself fortunate enough to have the ability, you should consider giving back to your community by supporting charities and nonprofits that are committed to making the world a better place to live. They might be helping children obtain good healthcare, opening educational doors for disadvantaged students, delivering nutritious meals to the homeless or connecting seniors with volunteer services.

With so many organizations doing good deeds, you should consider making a contribution to an organization that supports your personal values. As Marcus Lemonis says, “There is no being generous to a fault. Because there is no fault in being generous.”

But before making a donation, you should do your homework and learn as much as you can about the charity or nonprofit organization. Then, you should look at the many ways you can demonstrate your support.

After all, you should know how to donate to charities before automatically providing your credit card number or writing a check. And always be sure you are comfortable making a gift to the organization. As Marcus says, “Don’t compromise who you are.”

A Charity or a Nonprofit?

All charities are nonprofits, but not all nonprofits are charities. In fact, the Internal Revenue Code has many different classifications for nonprofit organizations, depending on their purpose. For example, a homeowner association or civic organization could be structured as a 501c(4) nonprofit. You could make a donation, but it would not be considered tax-deductible under most circumstances.

A nonprofit has one basic requirement, according to SCORE, a nonprofit resource partner of the U.S. Small Business Administration (SBA). None of the corporation’s net profit from donations, membership fees or business activities will benefit any individual. However, those funds can be used for many other purposes, including advocacy efforts like lobbying.

If a nonprofit earns a substantial part of its income from public solicitations, the IRS will define it as a public charity, typically structured as a 501c(3) nonprofit. As a charity, it must focus its spending on certain designated purposes, including charitable, educational, religious, scientific, amateur sports, and/or preventing cruelty to children or animals. If you donate to a 501c(3) charity, your contributions will generally be considered tax deductible.

Another type of charity is a private foundation. This is typically created and funded by a wealthy individual or family and used to support charitable endeavors. Two examples are the Rockefeller Foundation and the Bill & Melinda Gates Foundation.

So an important step in determining how to donate to charities is looking at the nonprofit’s mission statement and the “fine print” on the home page. If the nonprofit’s purpose is to support medical research, education, science, a faith-based initiative or a similar cause that benefits the public, it probably qualifies as a charity, and you will see the 501c(3) designation on the website.

As with all donations, you should contact your accountant, attorney or tax advisor to discuss the best options for you and your business.

Why Donate to Charities?

Donating to charities and nonprofits can have a lasting impact on many people, including yourself, your family and your business. If you donate to charities, you can accelerate medical research, feed the homeless, remove plastic waste from the ocean or advance hundreds of other worthy causes. While you may also gain tax or financial benefits, donating to a charity or nonprofit can be a step toward creating a personal legacy for future generations.

You can also set a good example for family members and friends, or your business partners and employees to also donate to charities. It can help those in your sphere of influence develop a spirit of collaboration and camaraderie, especially if you volunteer together, along with making donations. But the best reason to donate to charities is being able to express your personal values in a meaningful way.

Different Ways to Donate to Charities and Nonprofits

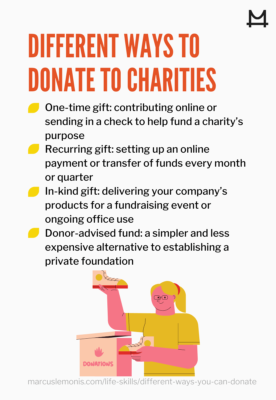

Once you have made a decision to become a philanthropist, the next question is how to donate to charities. Fortunately, there are many different ways to make a contribution, including financial gifts as well as donating your time, knowledge and energy to an important cause.

Here are several ways to donate to charities and nonprofits.

One-Time Gift

You can contribute online, or send in a check to help fund a charity’s purpose. This has the potential advantage of putting a limit on your support. If you find yourself short on funds later in the year, you can simply delay making another gift until your financial circumstances change.

Recurring Gift

You can also set up an online payment or transfer of funds every month or quarter. The benefit of this approach is that your gifts are made automatically, so you can focus your attention on business or personal matters. You will get email reminders and thank-yous for your payments.

In-Kind Gift

Your business may offer products or services that could benefit a charity or nonprofit as an “in-kind” gift. This option allows you to support a cause without having to dip into your cash flow or savings. Instead, you and your team could deliver your company’s products for a fundraising event or ongoing office use.

Donor-Advised Fund

You can create a donor-advised fund (DFA) as a vehicle for your charitable giving. It’s a simpler and less expensive alternative to establishing a private foundation. Basically, you put your contributions into the fund, which will be managed as an investment account by a financial institution. That allows your fund to grow in value, while you decide when and how much to donate to charities.

Donating Your Time

As you decide how to donate to charities, make it a point to consider serving as a volunteer. Many charities and nonprofits rely on experienced business leaders and professionals to guide their operations and keep them moving forward on their missions. Here are some of the ways you could give back to your chosen cause.

Join as a Volunteer

Almost any charity can benefit from your volunteer service. After looking at your work schedule, you might set aside a block of time every week to assist the charity or nonprofit in person or remotely. You could also be a flexible volunteer, taking on tasks that don’t require you to be available on a regular schedule. For instance, you could review the charity’s balance sheet, write a message to potential donors or prepare invitations to an upcoming event. Those are a few ways you can donate to charities without disrupting your daily business schedule.

Participate in a Fundraising Event

You can be a participant in a fundraising event, such as a walkathon or annual gala, generating more dollars for the charity. You could also serve on the planning or the event committee, providing support to the participants. In many cases, you can also invite family members, friends, partners and employees to take part as well, fostering a sense of teamwork.

Be a Business Mentor or Coach

As an entrepreneur, you probably have plenty of real-world experience in how to address organizational challenges. You could become a mentor or coach to a charity or nonprofit leader offering advice on people, processes and products – three cornerstones of Marcus’ philosophy.

Serve on the Board of Directors

This can be a very rewarding role, although it does require a significant commitment of your time, and possibly your financial support as well. As a volunteer leader of a charity or nonprofit, you can provide valuable oversight of its operations, while mapping out a strategic course for the future.

Now, it’s Time to Get Started!

Now that you know how to donate to charities, it’s time to turn that knowledge into action. Here are three quick tips to get you started.

1. Pick a Charity

Make sure its mission is aligned with your values and interests. Do your homework to see if it is making an impact, and check its nonprofit status in case you want benefits from a charitable tax deduction.

2. Review Your Time and Financial Resources

See what type of financial donation or volunteer commitment makes the most sense in your current circumstances. Hint: it’s usually better to start small and increase your involvement in the future.

3. Make a Gift

When you’re ready to make a donation, remember the Nike slogan and “Just do it!”

Making that first donation to a charity or nonprofit can be a tremendously rewarding experience. It can be the start of a lifetime journey into the world of philanthropy where success isn’t measured by what you make or what you keep. Instead, your success will revolve around what you give back!

- How do you currently donate to charities and nonprofits?

- Which strategies from the above can you leverage to start donating today?

Forester, D. (2019, July 17) What is the Difference between a Nonprofit Organization and a Charity?

Retrieved from https://www.score.org/resource/what-difference-between-nonprofit-organization-and-charity